Auto Insurance in and around Chicago

Looking for great auto insurance around the Chicago area?

All roads lead to State Farm

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

Flying objects, cracked windshields and darting deer, oh my! Even the most mindful drivers know that sometimes hazards get in your way. No one knows what to expect down the highway.

Looking for great auto insurance around the Chicago area?

All roads lead to State Farm

Navigate The Road Ahead With State Farm

Great car rental and travel expenses coverage, comprehensive coverage, uninsured motor vehicle coverage, and more, could be yours with insurance from State Farm. State Farm agent Jae Lee can explain which of those coverage options, as well as savings options like Drive Safe & Save™ and the good driver discount, you may be eligible for!

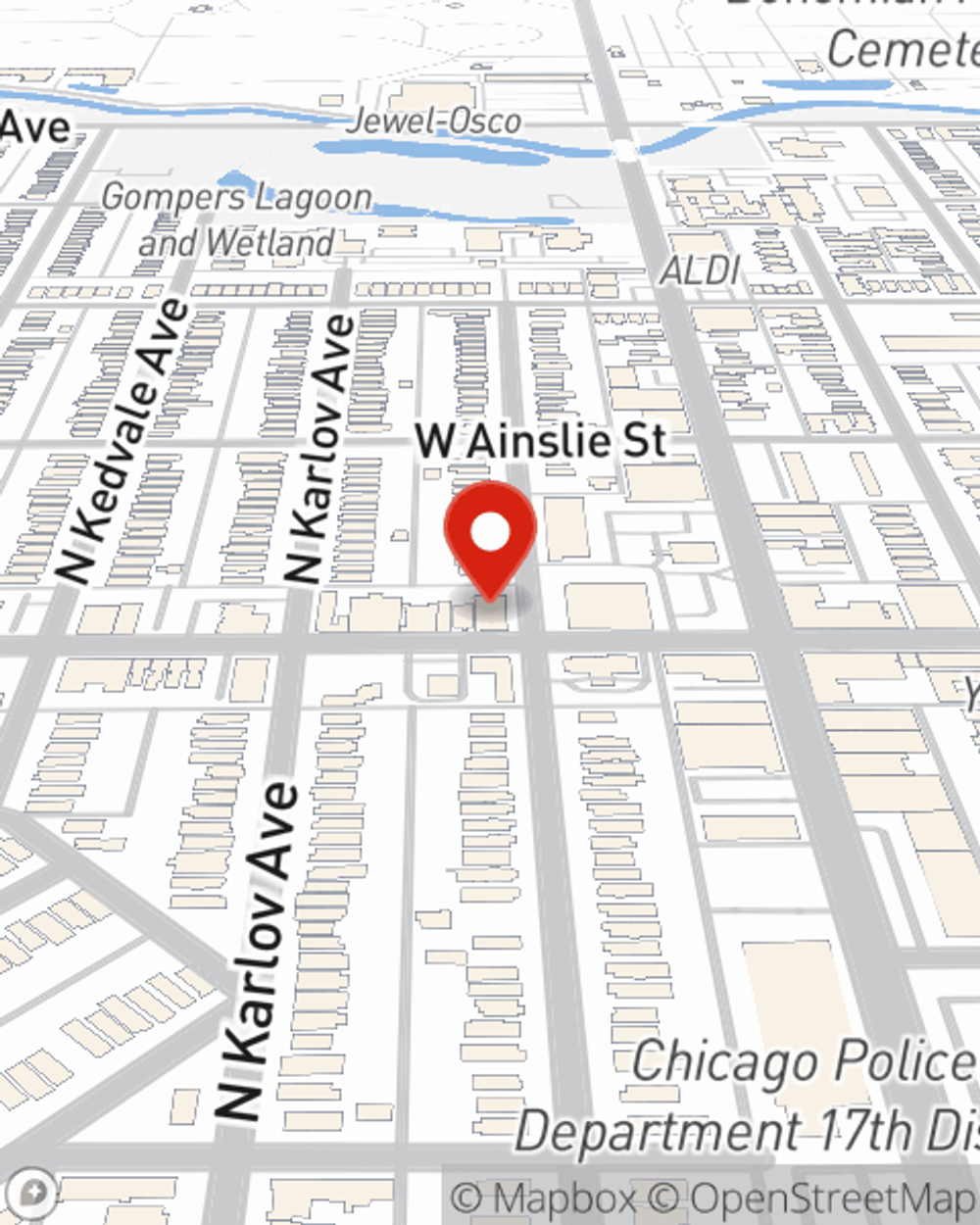

Don’t let accidents take you off track! Visit State Farm Agent Jae Lee today and discover the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Jae at (773) 736-8000 or visit our FAQ page.

Simple Insights®

Why is motorcycle insurance cheap?

Why is motorcycle insurance cheap?

The cost of motorcycle insurance can vary depending on the coverages you select. Learn more in this article.

How to safely sell a car in a few simple steps

How to safely sell a car in a few simple steps

Selling your car privately instead of to a dealership can be a good deal. State Farm has some tips to help you along the way.

Simple Insights®

Why is motorcycle insurance cheap?

Why is motorcycle insurance cheap?

The cost of motorcycle insurance can vary depending on the coverages you select. Learn more in this article.

How to safely sell a car in a few simple steps

How to safely sell a car in a few simple steps

Selling your car privately instead of to a dealership can be a good deal. State Farm has some tips to help you along the way.